Voodoo economic development part II

Since my last blog on voodoo economic development raised some comments and discussion, I thought I would explain it some more.

Voodoo ‘economics’, was first coined by George Bush senior in his fight for the Republican nomination in 1980 with Ronald Reagan, where he attacked the logic of Reaganomics.

Simple Reaganomics was focused on a ‘having your cake and eating it logic’, which was brilliant in its simplicity, namely that a lowering of taxes would improve the economy and lead to more tax revenues. This would happen because the low taxes would reduce the barriers for companies to produce (supply) goods and service. This would create a flood of products to the market, which would induce lower prices, as companies increasingly compete for business. This would in turn result in more consumer demand, increases in tax revenues, and would offset the tax decreases! George Bush senior called this logic ‘voodoo’.

Taking this notion into in economic development, I believe some policy surrounding economic development has voodoo elements. Some polices are useful, but they are not a panacea to creating growth. Public sector ‘getting out of the way’, business rate reductions, tax relaxations, or reducing planning restrictions have a role to play, but in many places we still need significant and hefty interventions.

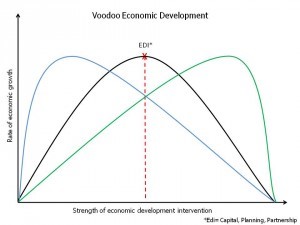

The diagram above (and apologies to Alfred Laffer and his tax income elasticity curve), looks at the variations in strength of economic development policy and how much you need to intervene to get growth. Too little intervention and you do not get optimum economic growth, too much and you may inhibit growth through too many bureaucratic barriers and obstacles.

As I have written elsewhere, we need to get better at deciding when to get involved, how deep to get involved, how long to hang around and when to get out. Ideally, if the abiding policy is economic growth (as is the government’s and all the LEPs’ aim) you must carefully calibrate policy, where you do just enough but not too much – why waste resources, time and energy? The mid-point (red line) is just enough, but this will vary by place.

In the areas lacking pre-existing capital, plans and collaboration – say parts of the north of England – the interventions will need to be strong and hefty. It also takes a while for economic growth to appear, even at quite high levels of intervention. This is the result of the depth of the problems, time lag or the failings of trickle down or leakage out of the location. In other areas there already are pre-existing conditions such as capital investment, for example in the City of London. Here, even with small scales of intervention, optimum growth can be achieved.

The trick in present local economic development policy is to assess whether economic development funds and interventions (RGF, LEPs, enterprise zones and business rate policy) are likely to be enough or even too much in some locations. It will vary by place, but economic development policy needs to carefully calibrate what is best for each area and assess the likelihood that trickle down will be high. Assume that you don’t need to intervene heftily (especially in the north), and in areas where the components of growth are weak is voodoo thinking.

The original article can be read on the NewStart website here.